Managing your expenses is essential for achieving financial stability and securing your future.

Adopting a few practical strategies allows you to manage your spending and save more.

Read on to discover five simple and practical tips to help you learn how to control your expenses and improve your financial well-being.

Tip #1: Create a Detailed Budget

A budget is a plan that outlines your income and expenses to help you manage your money.

It’s crucial to track spending, ensure you live within your means, and save for future goals.

Steps to Create a Simple Budget

A simple budget is an easy yet powerful way to manage your finances.

It helps you manage your income, control your expenses, and work towards your financial goals.

- Track Your Income: Record all sources of income, including salary, side jobs, and any passive income.

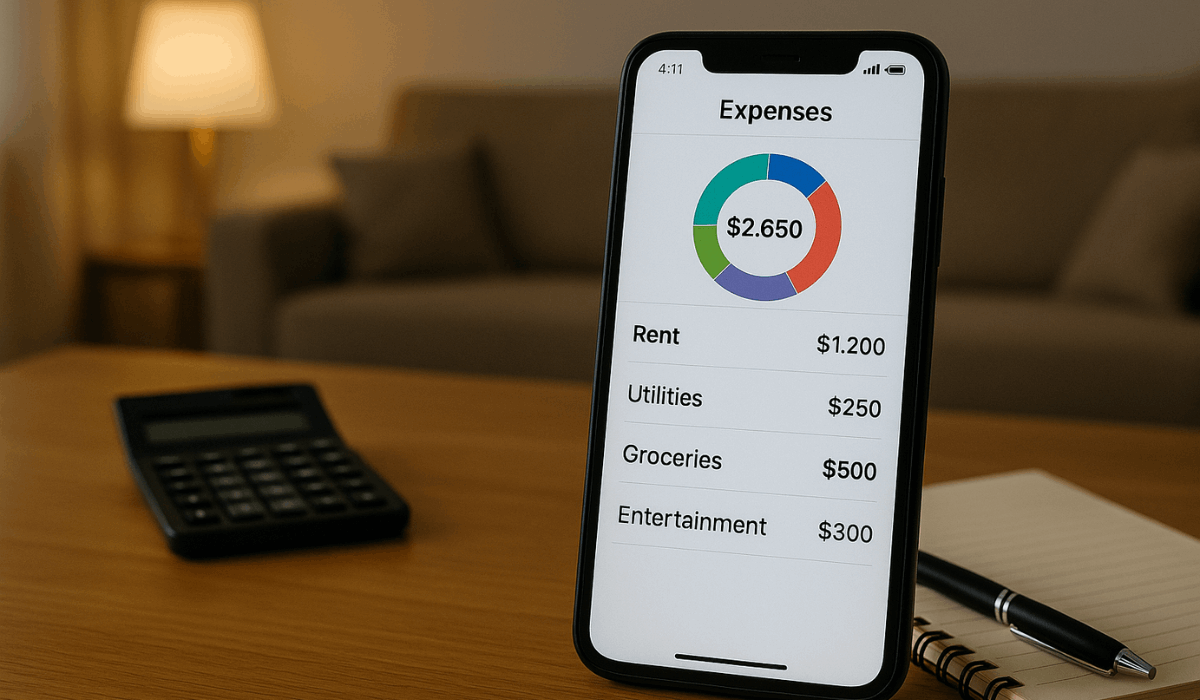

- List Fixed and Variable Expenses: Identify fixed monthly costs like rent and utilities, and variable expenses like groceries and entertainment.

- Set Spending Limits: Allocate specific amounts to each category based on your income and priorities.

- Monitor Your Spending: Regularly review your expenses to ensure you’re sticking to your budget.

- Adjust as Needed: Make changes if you overspend in one area or your income fluctuates.

Tools or Apps that Can Help with Budgeting

Using budgeting tools or apps can simplify the process of managing your finances.

These tools track your income and expenses, helping you stay organized and on top of your financial goals.

- Mint tracks your spending, categorizes expenses, and provides insights to help you manage your finances.

- YNAB focuses on a zero-based budget approach, helping you prioritize savings and manage your money more effectively.

- EveryDollar makes it easy to create monthly budgets, track spending, and stay on top of your financial goals.

- PocketGuard shows you how much disposable income you have after covering your bills, making it easier to manage day-to-day expenses.

- GoodBudget is a digital envelope budgeting system that allows you to track your cash and spending easily.

Tip #2: Track Your Spending

Tracking where your money goes helps you identify and control unnecessary expenses.

It ensures you stick to your budget and make informed financial decisions.

Ways to Monitor Spending

Monitoring your spending is essential for staying within your budget and avoiding financial surprises.

By tracking where your money goes, you can make adjustments to ensure you’re in control of your finances.

- Use Budgeting Apps: Apps like Mint or YNAB automatically track and categorize expenses.

- Review Bank Statements: Regularly check your bank and credit card statements for unexpected charges.

- Keep a Spending Journal: Manually record each purchase to see where your money goes.

- Set Alerts: Set up spending alerts with your bank to receive notifications when you exceed specific amounts.

- Track Receipts: Save and review receipts for each purchase to ensure accurate spending tracking.

Tip #3: Cut Unnecessary Subscriptions

Many people sign up for subscriptions and forget about them over time, leading to unnecessary spending.

Identifying and canceling forgotten subscriptions can free up money for other priorities.

- Streaming Services: Netflix, Hulu, Amazon Prime, Disney+, and other media platforms.

- Gym Memberships: Monthly fees for gyms or fitness apps that may no longer be used.

- Magazine Subscriptions: Print or digital subscriptions for publications are often overlooked.

- Cloud Storage Services: Services like Google Drive, iCloud, or Dropbox with automatic renewals.

- Software Subscriptions: You no longer use antivirus software, design software, or productivity tools.

- Subscription Boxes: Monthly deliveries for food, beauty, or hobby-related items that may not be needed.

- Online Classes or Courses: Courses or memberships to educational platforms that are no longer active.

Tips for Reducing Recurring Costs and Saving Money

Recurring costs, like subscriptions and memberships, can quietly drain your budget if you’re not careful.

Identifying and cutting back on these costs can free up money for more essential expenses or savings.

- Cancel Unused Subscriptions: Review your subscriptions regularly and cancel those you no longer use or need.

- Negotiate Bills: Contact service providers (internet, insurance, etc.) to negotiate lower rates or switch to cheaper plans.

- Switch to Annual Payments: Pay for services yearly instead of monthly to save on processing fees or receive discounts.

- Share Subscriptions: Share streaming or subscription services with family or friends to split costs.

- Eliminate Premium Services: Downgrade to basic plans for services you don’t fully utilize, like premium memberships or add-ons.

- Use Free Alternatives: When feasible, consider switching to free apps or services instead of paying for premium versions.

Tip #4: Shop Smart and Look for Discounts

Shopping smartly can help you save a significant amount of money.

Implementing a few strategies can help you stretch your budget and find the best deals on the things you need.

- Use Coupons and Promo Codes: Always search for available coupons or promo codes before making a purchase, both online and in-store.

- Wait for Sales: Plan major purchases around sales events like Black Friday, end-of-season sales, or holiday discounts to get the best prices.

- Sign Up for Store Loyalty Programs: Many stores offer rewards or discounts to loyal customers who sign up for their membership programs.

- Buy in Bulk: Purchasing items in bulk can save you money over time, especially for non-perishable goods.

- Compare Prices: Use price comparison websites or apps to ensure you get the best deal for the same product.

- Avoid Impulse Buying: Make and stick to a shopping list, avoiding unnecessary purchases that can quickly add up.

How to Use Cashback or Reward Programs to Your Advantage

Cashback and reward programs help you save money on everyday purchases.

Using them wisely can earn money or points on items you’re already buying.

- Choose the Right Cards: Pick credit or debit cards with high cashback or reward rates for your regular spending categories.

- Sign Up for Loyalty Programs: Many stores offer loyalty programs where you earn points for every purchase, redeemable for discounts or free items.

- Take Advantage of Bonus Offers: Look for promotions offering extra cashback or points, like sign-up bonuses or spending thresholds.

- Redeem Points Wisely: Use points for things you need, like travel rewards, gift cards, or cash back.

- Track Your Rewards: Keep track of your rewards and cashback balances to avoid missing expiration dates.

- Stack Offers: Combine cashback offers with store sales or coupons for double savings.

Tip #5: Set Financial Goals and Track Progress

Setting realistic short-term and long-term goals is essential for achieving financial success.

It helps you stay focused, measure progress, and stay motivated as you work toward your objectives.

- Define Your Goals Clearly: Be specific about what you want to achieve, whether saving a certain amount or paying off debt.

- Break Goals into Smaller Tasks: Divide long-term goals into manageable short-term tasks to make them less overwhelming.

- Set a Timeline: Assign realistic deadlines for achieving short-term and long-term goals based on your current situation.

- Prioritize Goals: Focus on the most critical goals and tackle them individually to avoid feeling overwhelmed.

- Track Your Progress: Regularly assess your progress to see if you’re on track and make adjustments.

- Adjust as Needed: Be flexible and adjust your goals or timelines if circumstances change or you face obstacles.

The Bottomline

By implementing these simple tips, you can take control of your spending and improve your financial health.

Start today by creating a budget, tracking expenses, and setting clear goals.

Take action to build a more secure financial future and achieve your money management goals.