If you’re considering obtaining a PayPay Card, understanding the application process and the digital wallet features it offers is essential.

The PayPay Card, issued by PayPay Card Corporation, is a convenient financial tool that integrates seamlessly with the PayPay app, allowing users to manage their finances efficiently.

This article will guide you through the steps on how to apply for the PayPay Card, explore its digital wallet functionalities, and provide information on associated fees, contact details, and eligibility requirements.

Understanding the PayPay Card

The PayPay Card is a credit card that offers a range of benefits designed to enhance your financial experience.

By linking the card to the PayPay app, users can enjoy features such as cashless payments, reward point accumulation, and easy access to transaction history.

The integration with the PayPay platform allows for a seamless and secure payment experience, whether you’re shopping online or in-store.

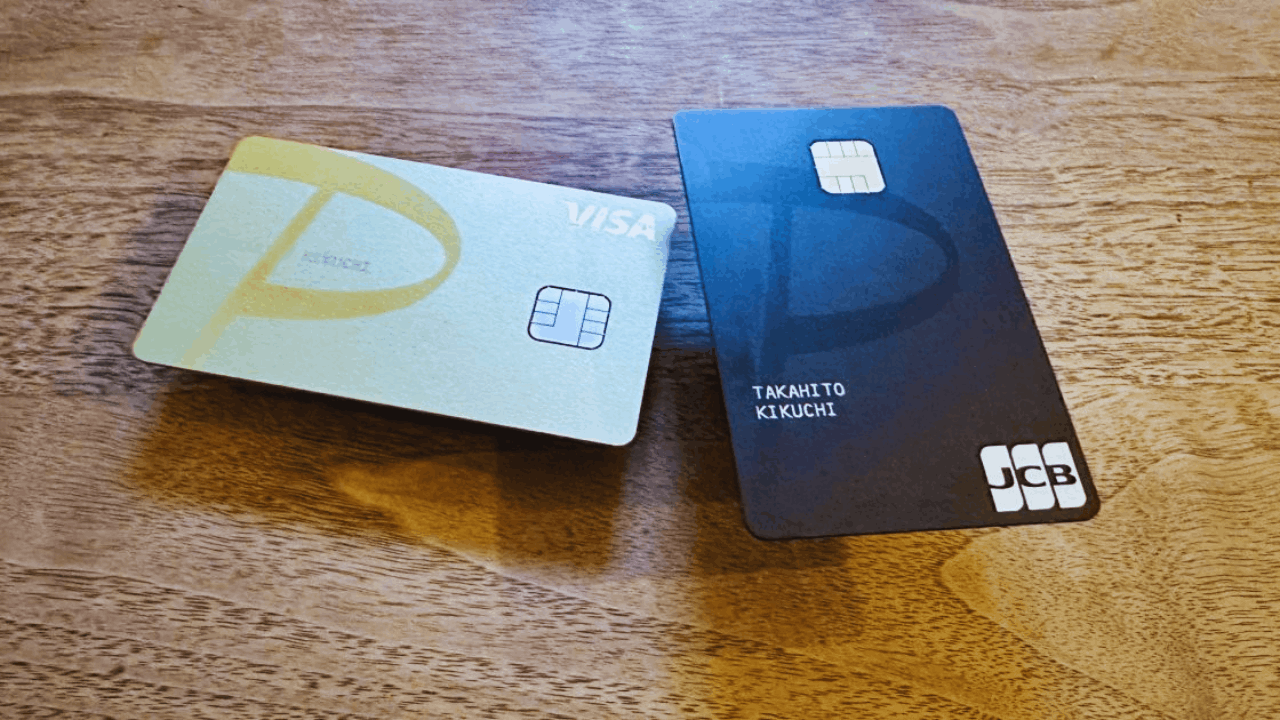

Additionally, the PayPay Card offers various types, including standard and premium options, catering to different user needs and preferences.

Key Features of the PayPay Card

One of the standout features of the PayPay Card is its integration with the PayPay app, enabling users to make cashless payments effortlessly.

The card also allows for the accumulation of reward points on purchases, which can be redeemed for various benefits. Users can access their transaction history through the app, providing a clear overview of their spending habits.

Furthermore, the PayPay Card offers enhanced security features, ensuring that your financial information remains protected.

Benefits of Using the PayPay Card

Using the PayPay Card comes with several advantages. The card’s integration with the PayPay app allows for quick and secure payments, both online and at physical stores.

The accumulation of reward points provides users with opportunities to enjoy discounts and other perks.

Additionally, the card’s security features, such as real-time transaction alerts and fraud protection, offer peace of mind when making purchases.

How to Apply for the PayPay Card

Applying for the PayPay Card is a straightforward process that can be completed online.

Whether you’re a resident of Japan or a foreign national, the application steps are designed to be user-friendly and efficient.

Step-by-Step Application Process

To begin the application, visit the official PayPay Card website. Select the type of card that best suits your needs and click on the application link.

Fill out the required information, including personal details, employment status, and income information. After applying, PayPay Card Corporation will review your details and notify you of the approval status.

Required Documentation for Application

To complete your application, you’ll need to provide certain documents. These typically include a valid residence card, proof of income, and identification. Having these documents ready can expedite the application process and help prevent any delays.

Processing Time and Card Issuance

Once your application is approved, the PayPay Card will be mailed to your registered address.

The processing time is generally a few business days, and you’ll receive instructions on how to activate your card. Upon activation, you can start using your PayPay Card for purchases and enjoy the associated benefits.

Digital Wallet Features of the PayPay Card

The PayPay Card offers a range of digital wallet features that enhance the user experience.

By linking your PayPay Card to the PayPay app, you can manage your finances conveniently from your smartphone.

Cashless Payments

With the PayPay Card linked to the PayPay app, you can make cashless payments at participating merchants. Simply scan the QR code at checkout, and the payment will be processed securely.

This feature eliminates the need to carry physical cash, making transactions more convenient.

Reward Points Accumulation

Every purchase made with the PayPay Card earns you reward points, which can be redeemed for various benefits.

The accumulation of points encourages users to make purchases using the card, enhancing the value of each transaction.

Transaction History Access

The PayPay app provides users with easy access to their transaction history. You can view details of your purchases, monitor your spending habits, and manage your finances effectively.

This feature promotes financial transparency, helping users stay on top of their expenses.

Enhanced Security Features

The integration of the PayPay Card with the PayPay app ensures that your financial information is protected.

Features such as real-time transaction alerts and fraud detection mechanisms provide an added layer of security, giving users peace of mind when making purchases.

Fee Structure of the PayPay Card

Understanding the fee structure associated with the PayPay Card is crucial for effective financial planning.

The fees can vary depending on the type of card and the services utilized.

Annual Fees

The PayPay Card may have an annual membership fee, which can vary based on the card type. Standard cards typically have a lower fee, while premium cards may have a higher fee due to additional benefits.

It’s important to review the specific terms and conditions of your chosen card to understand the applicable fees.

Interest Rates

Interest rates on the PayPay Card apply to outstanding balances carried beyond the due date.

The rates can vary based on your credit profile and the card type. To avoid interest charges, it’s advisable to pay off your balance in full each month.

Other Charges

In addition to annual fees and interest rates, there may be other charges associated with the PayPay Card.

These can include late payment fees, over-limit fees, and cash advance fees. Understanding these charges can help you manage your card usage and avoid unexpected costs.

Contact Details and Main Office Address

For immediate assistance with card-related inquiries, you can reach out to the PayPay Card Corporation’s customer service hotline.

Their team is available during business hours to help resolve any questions you may have about your card or account. This service ensures that you receive the support you need promptly.

PayPay Card Corporation’s Main Office

For those who prefer in-person assistance, PayPay Card Corporation’s main office is located at Yotsuya Tower, 1-6-1 Yotsuya, Shinjuku-ku, Tokyo 160-0004, Japan.

This office serves as the hub for all PayPay Card operations, where various card services are managed. It’s the central point for customer support and inquiries related to PayPay Card services.

Eligibility Requirements for the PayPay Card

To apply for the PayPay Card, applicants must meet certain eligibility criteria set by PayPay Card Corporation.

These requirements ensure that the card is issued to individuals who can manage their finances responsibly.

Age and Residency Requirements

Applicants must be at least 18 years old and have a registered address in Japan.

Both Japanese citizens and foreign nationals residing in Japan are eligible to apply.

Employment and Income Verification

A steady source of income is essential for qualifying for the PayPay Card. Applicants must provide documentation such as recent pay slips, tax returns, or a certificate of employment.

This helps PayPay Card Corporation assess the applicant’s ability to manage their finances and repay any debts incurred.

Credit History

A good credit history is also typically required, as it reflects an individual’s ability to manage financial obligations.

PayPay Card Corporation may conduct a credit check as part of the application process.

Conclusion

In conclusion, understanding how to apply for the PayPay Card and exploring its digital wallet features are essential steps in managing your finances effectively.

By meeting the necessary eligibility requirements and following the application process, individuals can enjoy the advantages of this versatile financial product.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.