Many consumers in Japan are curious about the Sumitomo Mitsui online application process for credit cards, especially given the popularity and trustworthiness of this issuer.

Sumitomo Mitsui Card Company offers a range of card types including the basic NL card, Gold, Platinum, and student cards.

Understanding how to apply online, along with key features, interest rates, and contact support, helps applicants make informed decisions. This article outlines each step clearly and accurately using official data.

Understanding the Sumitomo Mitsui Online Application Process

Sumitomo Mitsui Card Company provides a streamlined online system for submitting credit card applications directly through its official website.

This process typically takes about ten to fifteen minutes when using a desktop or smartphone.

Applicants are guided through personal, employment, and income fields, followed by document uploads and identity verification.

Once submitted, SMCC screens the application, and the result is usually returned within days.

Choosing Your Card Type and Starting Your Application

Applicants begin by selecting the card type that best suits their needs—basic NL, Gold, Platinum, or student card—through the Sumitomo Mitsui website.

The application is available only in Japanese and begins with your personal and contact information. You then provide employment status and expected income details before choosing optional services like ETC or family add-ons.

This initial selection ensures the application process matches your eligibility and desired features.

Identity Verification and Document Submission

The application requires uploading identification, such as a My Number card or residence card, alongside a selfie video to meet Japan’s eKYC regulations.

Income verification documents are needed for higher credit limits or premium cards. Upload files must be clear and current to avoid rejection. This step ensures secure and accurate identity validation before approval.

Review, Approval, and Card Delivery

After submission, SMCC reviews your information using automated credit and eligibility checks.

Communication of the decision is usually via email or text message, and approved applicants receive their card by mail.

Activation can be completed through the Vpass app or the member website. It is important to submit applications during weekday business hours for faster processing.

Features of the Sumitomo Mitsui Cards

Sumitomo Mitsui cards offer a strong suite of core features that appeal to a variety of users—from students to frequent travelers.

These include the V Point rewards program, support for digital wallets, and optional ETC for expressway tolls.

Additional perks vary by card type and may include travel insurance, concierge service, lounge access, and family card integration. Knowing these features helps applicants select the card that meets their lifestyle needs.

V Point Rewards and Digital Payment Integration

Cardholders earn V Points with every purchase, typically one point earned per 200 yen spent, with bonus opportunities through campaigns and the Olive integrated payment system.

Points can be redeemed for merchandise, statement credit, or transfer to partner services.

The cards are compatible with Apple Pay, Google Pay, iD, and QUICPay systems, offering flexibility in payments. This rewards and payment ecosystem enhances everyday usability and savings.

Premium Benefits and Add‑On Features

Higher-tier cards like Gold and Platinum include domestic and overseas travel accident insurance, access to airport lounges, and concierge assistance.

Family cards can be added with shared benefits and spending limits, making them ideal for households or corporate use.

ETC card functionality enables seamless tollway payments without additional login. These enriched features add practical value to card ownership depending on usage patterns.

Security Measures and Ongoing Account Management

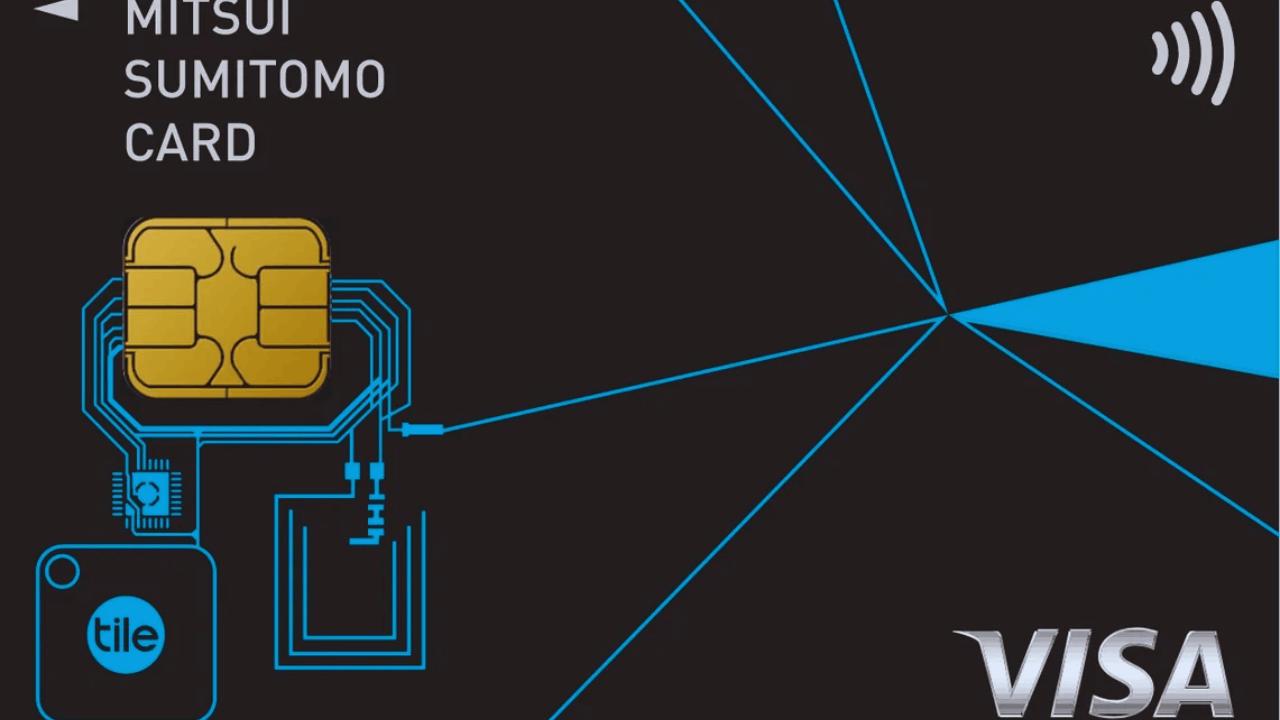

All cards use EMV chip technology, and the NL model even removes printed card numbers in favor of app‑based credentials for enhanced security.

Vpass and Olive apps provide card management, statement review, settings adjustments, and reporting tools in one place.

Real‑time alerts send purchase notifications directly to your device to prevent fraud. This multi‑layered security environment helps cardholders stay informed and protected.

Interest Rates, Fees, and Charges

Understanding the financial terms is essential when evaluating whether to apply for a Sumitomo Mitsui card.

Interest only accrues if you use revolving or installment payment options; standard card balances are due in full monthly.

Annual fees vary by card tier, but many basic options are fee‑free. Late payments and cash advances incur higher charges, subject to legal caps on interest rates.

Purchase and Cash Advance Annual Percentage Rates

The revolving purchase APR is typically 15.0 percent annually, while cash advance rates fall between 14.4 and 18.0 percent, depending on your credit line and usage.

These rates are capped under Japanese regulations and applied only when balances are carried forward or cash is withdrawn.

Paying in full each month avoids interest entirely. Knowing this helps borrowers avoid unnecessary finance charges.

Annual Fees Based on Card Type

Basic NL cards usually carry no annual fee, while Prime Gold, Gold, and Platinum levels have fees ranging from approximately ¥5,500 to ¥33,000 annually.

Some fees are waived for high spenders or via online billing conditions. First year’s fee is often waived or offset through bonus V Points campaigns. Understanding these costs helps compare long‑term value across tiers.

Penalties and Foreign Transaction Charges

Late payment penalties can be as high as 20.0 percent annualized, applied only to overdue balances.

Overseas transactions carry a conversion fee, typically around 2.2 to 3.63 percent applied to international purchases.

Cash advance interest begins accumulating immediately, making it the most expensive usage option. Awareness of these charges helps cardholders manage their behavior responsibly.

Contact Details and Customer Support

Sumitomo Mitsui Card Company provides multiple support channels to respond to inquiries about application status, card services, and assistance with premium cards.

Support includes general, Gold, Platinum, and induction desks with toll‑free Japanese numbers. Hours vary by service type, with some lines operating year‑round.

Written or online contact is also available through official websites for non‑urgent questions.

General and Premium Card Support Lines

General inquiries for card applicants can be made via the induction desk. Gold and Platinum cardholders have dedicated lines open daily except during the New Year’s holidays.

Each support desk handles card-specific queries, including benefits, status checks, and usage issues. These designated channels ensure accurate help for different card types.

Address and Corporate Contact Information

The headquarters for Sumitomo Mitsui Card Company is located in the SMBC Toyosu Building, Koto‑ku, Tokyo.

Physical correspondence and official mail can be sent to this address. Applicants or cardholders may visit local SMBC Trust Bank branches for assistance with Olive integrated account issues.

This centralized presence ensures accessibility for both domestic and international users.

Online Support and Documentation Resources

The Sumitomo Mitsui website offers FAQs, service simulators, terms, and English reference guides for card applications.

These materials help users estimate payments, interest charges, and compare card types before applying.

Up‑to‑date terms and conditions are available in digital formats. This transparency supports informed decision‑making by applicants.

Conclusion

Knowing the Sumitomo Mitsui online application process equips you to apply confidently and choose the card that matches your lifestyle. With clear steps, secure identity validation, and flexible features including V Point rewards and integrated digital tools, the application journey is accessible and efficient.

If you reside in Japan and meet the eligibility criteria, applying online offers a seamless path to owning a trusted credit card option tailored to your needs.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.